Mineral Applications

Mexican legislation provides that the lands and waters within the national territory belong to the Mexican state. Mexico has the right to transfer title there to private hands in order to constitute private property.

The law permits up to 100% private ownership in exploration, development and production of mineral resources.

Mining concessions may only be granted to Mexican nationals and companies. Companies must reside in México and foreign participation in the ownership of such companies must comply with the provisions of the Foreign Investment Law. The Foreign Investment Law allows 100% foreign-owned Mexican firms to obtain concessions.

Concessions are required for the exploration and exploitation of mineral resources. Concession holders are required to negotiate with the surface land owner to access the land under which the concession is located. Currently there is no distinction between the exploration and the exploitation mining concessions.

Mining duties are assessed based upon the size of the mining lot (tenement).

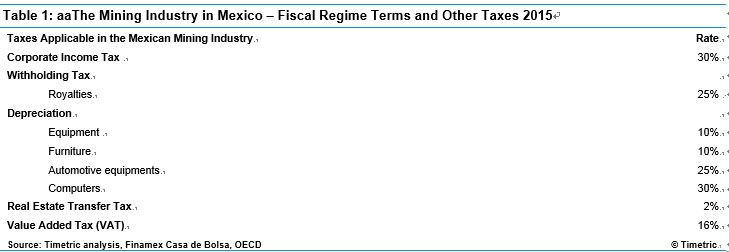

Economic Considerations/Land value/Corporate taxes are calculated as a percentage of the invoice value of the minerals extracted and sold under the mining concession.

Currently no Royalties are charged